Board of Directors

Introduction of Members of the Board of Directors

Please see here for an introduction to the board members.

Approach to the Composition of the Board of Directors

As of June 27, 2024, the Board of Directors consists of 11 directors, of whom four, or at least one-third, are independent external directors, and four Audit & Supervisory Board members*.

The Company selects persons of excellent character and insight who have the professional expertise, extensive business and management experience necessary to maintain the Company’s sustainable growth as officer candidates, with gender and nationality diversity taken into consideration. In addition, in regard to independent external directors and independent outside corporate auditors, the Company invites the number necessary for the sustainable growth of the Company, with a minimum of two independent external directors and a number of independent outside corporate auditors that is greater than or equal to half of the total number of corporate auditors. Furthermore, all outside officers shall meet the judgment standards for independence.

In addition, the Company takes into consideration the continuity and growth of the business, as well as the development of successors, and determines the balance between the current and newly appointed officers, operating executives, and non-operating executives.

*In accordance with the Articles of Incorporation, the Board of Directors consists of a maximum of 12 directors and four Audit & Supervisory Board members.

Independence Standards for External Officers

If external directors, external Audit & Supervisory Board members, and candidates thereof fulfill the following conditions, the Company will determine that they possess adequate independence from the Company.

- (1)The person is not currently an executive director, etc.*2, of the Group*1, and was not an executive director, etc., of the Group in the past. For external Audit & Supervisory Board members, in addition to the above, the person was not a non-executive director of the Group.

- (2)Within the present fiscal year and within the past three fiscal years, none of the following items applied.

- 1)The person holds the Group as a major transaction partner*3 or is an executive director, etc., of said transaction partner.

- 2)The person is a major transaction partner of the Group*4 or is an executive director, etc., of said transaction partner.

- 3)The person is a consultant, accounting specialist or legal specialist that receives a significant amount of cash*5 or property other than executive remuneration. Additionally, if the party receiving said property is an organization such as a corporation or association, then a person affiliated with said organization.

- 4)The person is a major shareholder of the Company*6 or is an executive director, etc., of said major shareholder.

- 5)The person is from an organization such as a corporation or association that receives donations or supports exceeding a certain amount*7 from the Group.

- (3)The person is not currently a spouse or relative to within the second degree of a person to which any of the following apply.

- 1)An executive director, etc., or a non-executive director of the Group. However, for persons who are employees also serving as executive directors, etc., this is limited to significant employees*8.

- 2)Significant persons*9 to which any of (2) 1) to 5) apply.

- (4)The person is not a director, Audit & Supervisory Board member, executive, managing officer, or employee of a company with which the Group has a mutual seconding of directors, Audit & Supervisory Board members, executives, or managing officers.

- (5)None of the following items apply to the person.

- 1)Persons with which there may be a conflict of interest with general shareholders.

- 2)Persons with a total term of office exceeding eight years.

Notes:

- *1. The Group refers to the Company and subsidiaries of the Company.

- *2. Executive directors, etc., refer to executive directors, executives, managing officers, managers, and other employees.

- *3. Persons who hold the Group as a major transaction partner are persons that receive payment from the Group of 2% or more of total annual consolidated net sales of said transaction partner.

- *4. Major transaction partners of the Group are persons to which any of the following apply. 1) Persons whose payment to the Group is 2% or more of total annual consolidated net sales of the Group. 2) A financial institution whose balance of loans to the Group as of the end of the fiscal year comprises 2% or more of total consolidated assets of the Group.

- *5. A significant amount of cash is 10 million yen per annum or 2% or more of consolidated net sales or total revenue for said corporation, whichever amount is greater, on average for the past three fiscal years.

- *6. Major shareholders are shareholders that hold stocks accounting for 10% or more of total voting rights.

- *7. A certain amount is 10 million yen per annum or 30% or more of total annual expenses for said corporation, whichever amount is greater, on average for the past three fiscal years.

- *8. Significant employees are employees that are in upper levels of management, such as general managers or above.

- *9. Significant persons are certified public accountants, attorneys (including so-called associates), corporate.

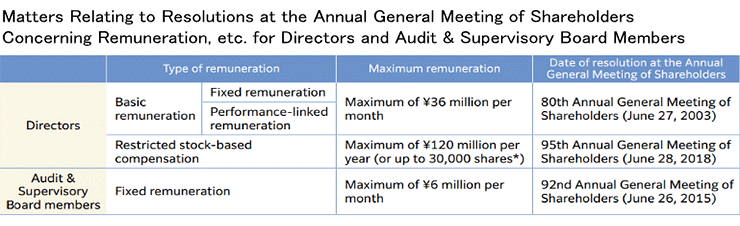

Remuneration for Officers

Basic Policy

- • Remuneration will be used to provide strong incentives to contribute to sustainable growth and the enhancement of corporate value through the realization of the Company’s medium- to long-term management strategies.

- • Remuneration will be provided at a level that allows the Company to recruit and retain human resources capable of realizing its corporate philosophy.

- • Remuneration will be used to build shared interests with shareholders and heighten management awareness regarding shareholder perspectives.

- • The functionality of the Personnel Remuneration Committee will be enhanced to ensure the objectivity and transparency of processes relating to the determination of remuneration.

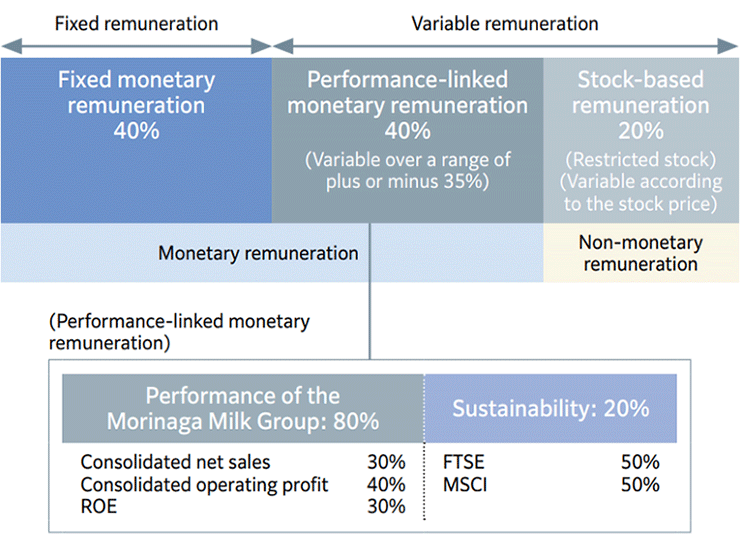

● Composition of Remuneration

- • Remuneration for directors (excluding external directors) consists of basic remuneration, comprising fixed remuneration and performance-linked remuneration, together with stock-based compensation (restricted stock-based compensation) provided as medium- and long-term incentives.

- • The relative amounts of each type of remuneration if basic remuneration includes performance-linked remuneration will be approximately 40% fixed remuneration, 40% performance-linked remuneration, and 20% stock-based compensation.

- • Remuneration for external directors and Audit & Supervisory Board members consists solely of fixed remuneration and does not include stock-based compensation or other performance-linked remuneration.

In addition, in order to share the benefits and risks of stock price fluctuations with all shareholders and to further motivate directors (excluding external directors) to contribute to stock price increases and improvements in corporate value, we have introduced a restricted stock compensation plan.

In a resolution of the Board of Directors' meeting held on April 26, 2023, the Company made the following changes to the method of determining performance-linked remuneration for directors. In addition to increasing the ratio of ROE, an indicator for evaluating company-wide group performance, in order to realize management that is conscious of the cost of shareholders' equity and stock price, the Company has made it possible for the evaluation of sustainability activities to be directly reflected in the performance-linked remuneration. The method of determining performance-linked remuneration based on this decision will be applied to remuneration paid in July 2024 and thereafter.

*A stock split was implemented at the rate of two shares for every one share of common stock with an effective date of December 1, 2023. This stock split had the effect of changing the limit for the number of restricted shares from 15,000 to 30,000 shares.

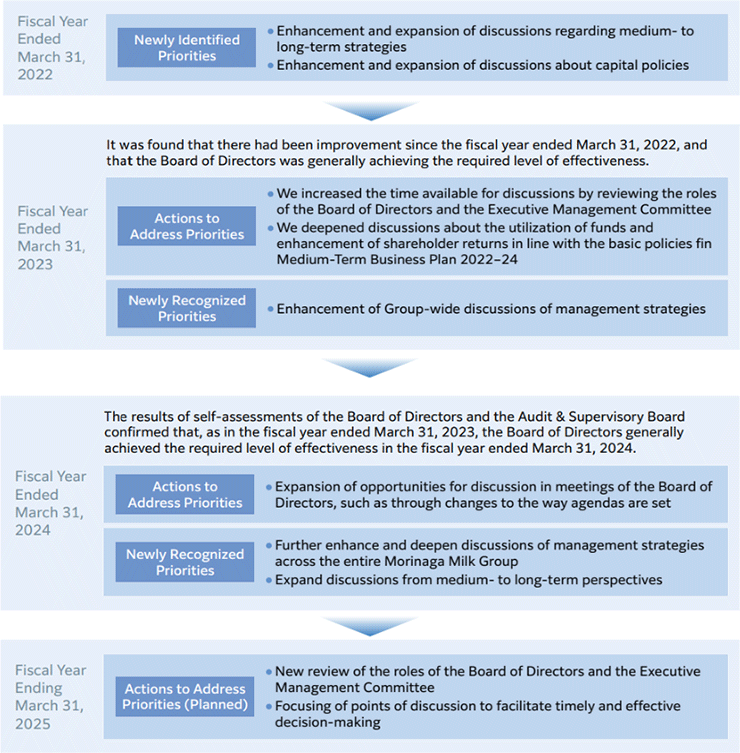

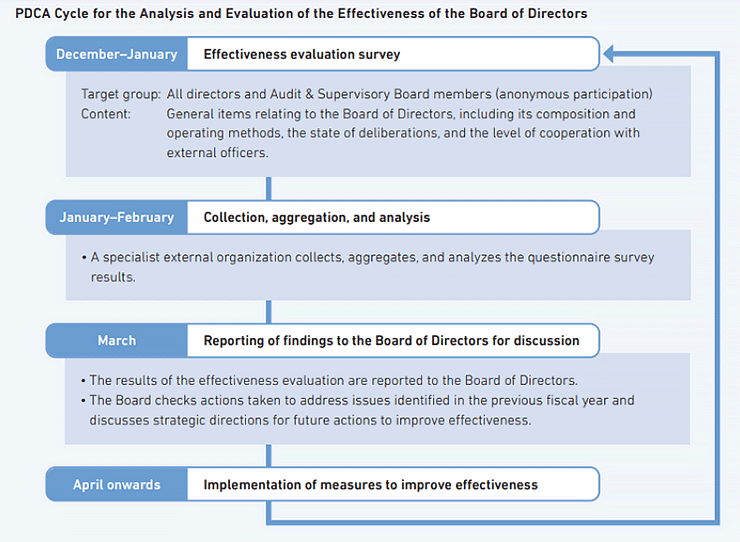

Evaluating the Effectiveness of the Board of Directors

The Company analyzes and evaluates the effectiveness of its Board of Directors as the basis for improvements to its functionality. By addressing issues identified through these evaluations, we enhance corporate governance and better focus our management systems toward further sustainable improvement of corporate value.

Evaluation Process

The Company conducts an anonymous survey of its directors and Audit & Supervisory Board members and uses an external organization to collect, aggregate, and analyze the results. The results of this aggregation and analysis process are then shared with the Board of Directors for evaluation.

Key Evaluation Items

Actions to Address Issues