Action to Implement Management That is Conscious of Cost of Capital and Stock Price

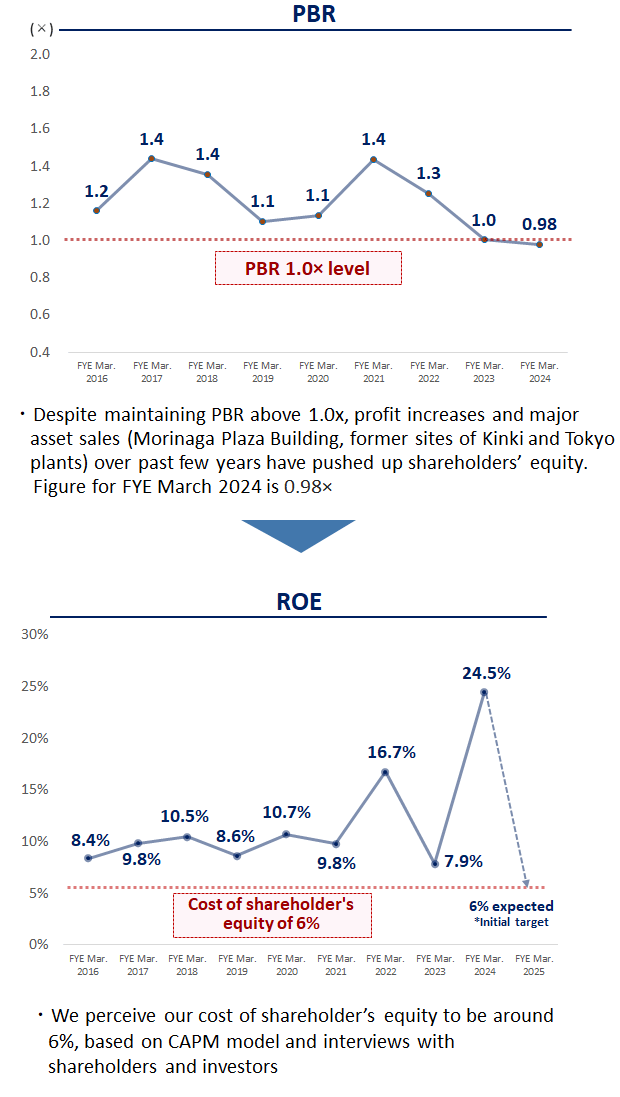

Despite maintaining PBR above 1.0× and ROE of over 8% over recent years, shareholders’ equity has risen recently(as of May 2024) due to impact of major asset sales, etc., pushing down ROE. Although we perceive our cost of shareholder’s equity to be around 6%, based on CAPM model and interviews with shareholders and investors, we recognize importance of quickly returning to 8% or more.

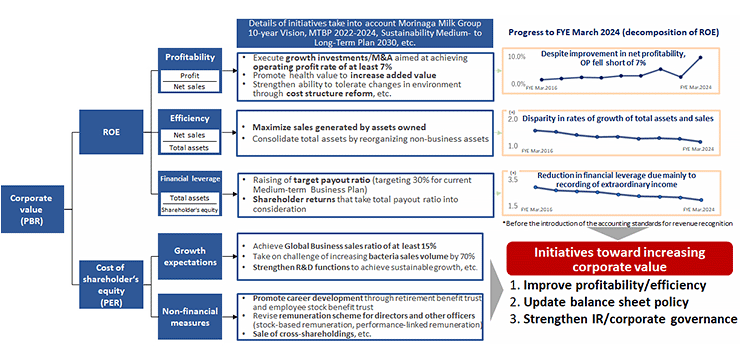

In accordance with policies (Morinaga Milk Group 10-year Vision, Medium-Term Business Plan 2022–2024, and Sustainability Medium- to Long-Term Plan 2030, etc.,) the Company is pursuing initiatives to improve its ROE and PER. In order to meet the expectations of stakeholders and achieve sustainable growth and further improvement in corporate value, the Company will work on the three points “Improving profitability/efficiency,” “Updating balance sheet policy,” and “Strengthening IR/corporate governance.”

May 14, 2024 Action to Implement Management That is Conscious of Cost of Capital and Stock Price

1. PBR and ROE

Despite maintaining PBR above 1.0× and ROE of over 8%, shareholders’ equity has risen recently due to impact of major asset sales, etc., pushing down ROE, but we recognize importance of quickly returning to 8% or more

Here are our PBR and ROE trends. In both indicators, we are once again aware of the challenges.

We believe it is important to raise ROE to 8% or more.

2. Our Perception of Issues, and Overview of Initiatives Aimed at Increasing Corporate Value

We will work on 1. Improve profitability/efficiency, 2. Update balance sheet policy, and 3. Strengthen IR/corporate governance, to increase corporate value

This is our perception of issues, and overview of initiatives aimed at increasing corporate value.

Three major policies for improving both PBR and ROE indicators are shown in the lower right-hand corner. The first is to improve profitability and efficiency, the second is to update balance sheet policies, and the third is to strengthen investor relations and corporate governance.

In making this disclosure, in addition to the arrangement shown here, we wanted to make our response measures more specific, and among them, we focused on changes in our response to the capital structure and took the form of presenting specific measures.

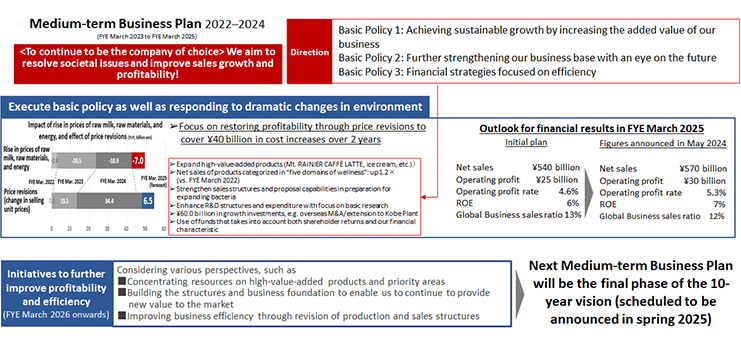

3. Initiatives to Improve Profitability and Efficiency

In this dramatically changing environment our focus is on executing price revisions and restoring profitability. There has been no change in the positioning or direction of the current MTBP within the 10-year vision; we will steadily execute initiatives in line with policy (next MTBP scheduled to be announced in spring 2025)

Here are our efforts to improve profitability and efficiency.

With regard to R, which is the numerator of ROE, we have made a certain amount of progress in the past two years, when the environment has been changing dramatically, and we have been able to raise the forecast from the original plan of Medium-Term Business Plan 2022–2024. We believe that initiatives in line with the direction and policies we are aiming for in the current medium-term business plan will lead to improved profitability, and we will continue to make steady efforts.

We are currently in the process of formulating the next medium-term business plan. As noted at the bottom of this slide, we are focusing on perspectives such as focusing resources, building a value delivery infrastructure, and improving business efficiency. We plan to present the plan again as both of these items will contribute to increasing profitability and efficiency.

【Supplementary Information】

The Medium-Term Business Plan 2025-2028 was announced on May 13, 2025.

The Medium-Term Business Plan 2025-2028 aims to realize the Morinaga Milk Group's 10-year vision set forth in 2019 and achieve its numerical targets, while also taking a step further toward becoming “A Clearly Differentiated and Highly Profitable Company.”

The three basic policies are “growth strategy,” “structural reforms,” and “culture reforms.” Under “growth strategy,” we will concentrate management resources in areas where we can leverage our strengths. Under “structural reforms,” we will improve efficiency by reorganizing our organization and restructuring our production system. Under “culture reforms,” we will promote initiatives to build an energetic team with professional skills and diversity.

Please refer to this page for more details.

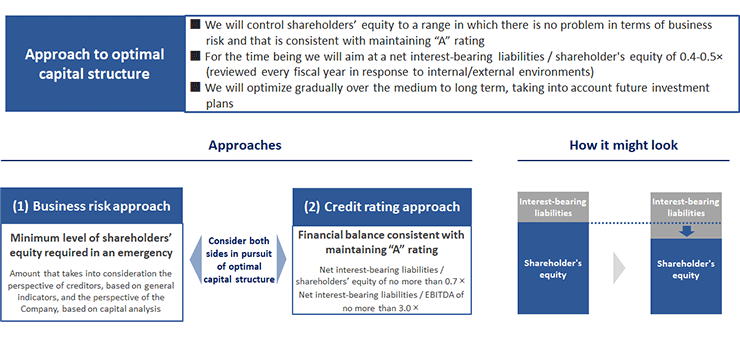

4. Update Balance Sheet Policy (Optimal Capital Structure)

While preserving financial soundless, we will update the balance sheet policy with the aim of maximizing corporate value by pursuing the optimal capital structure and reducing the cost of capital. Going forward we aim for growth while utilizing a certain amount of debt.

This is balance sheet policy, optimal capital structure.

We will pursue an optimal capital structure while ensuring financial soundness. We intend to reduce the cost of capital and maximize corporate value.

To date, our approach to financial strategy has been to emphasize safety. While continuing to place importance on this point, we intend to utilize a certain degree of debt and leverage our operations in accordance with the new policy described here.

Taking into consideration the two approaches in the slide (business risk approach and credit rating approach), as well as future investment plans, we will gradually reduce the ratio of shareholders' equity and optimize the capital structure.

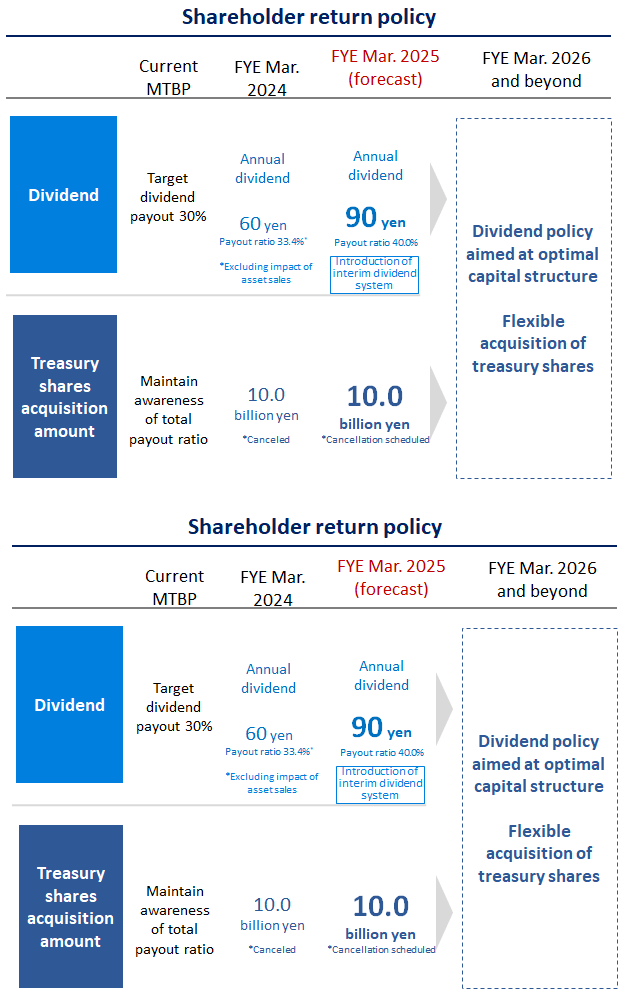

4. Update Balance Sheet Policy (Shareholder Return Policy)

Enhance shareholder returns based on balance sheet policy that pursues optimal capital structure Raise annual dividend from 60 yen in the previous fiscal year to 90 yen in FYE March 2025, with another ¥10.0 billion in treasury share acquisitions planned for FYE March 2025 in a continuation of the previous fiscal year

This is about strengthening shareholder returns as one of the specific measures to optimize the capital structure.

In the course of discussions on optimal capital structure, we have considered shareholder returns from various perspectives. As a result, we plan to increase the annual dividend for the fiscal year ending Mar. 2025 from JPY60 to JPY90. The dividend payout ratio is 40% for the initial forecast. The Company has paid only year-end dividends in the past but plans to introduce an interim dividend system starting this fiscal year (the fiscal year ending Mar. 2025). In addition, following the previous fiscal year, the Company has decided to repurchase up to JPY10 billion of its own shares in the fiscal year ending Mar. 2025. All shares acquired will be canceled as in the previous year.

At this time, we have not changed our basic approach, which is to target a dividend payout ratio of 30% in the current medium-term business plan and to be conscious of the total return ratio. We are currently considering our future shareholder return policy, while carefully examining the balance between investment in growth and shareholder returns, based on the concept of optimal capital structure and the formulation of the next medium-term business plan.

【Supplementary Information】

(Announced on May 13, 2025, “Medium-Term Business Plan 2025-2028”)

In the Medium-Term Business Plan 2025-2028, we have raised our dividend payout ratio target to 40%. We announced our plan to acquire 10.0 billion yen worth of treasury stock in the FYE March 2026 at the same time as the announcement of the Medium-Term Business Plan. We will continue to consider flexible responses in accordance with circumstances in the future.

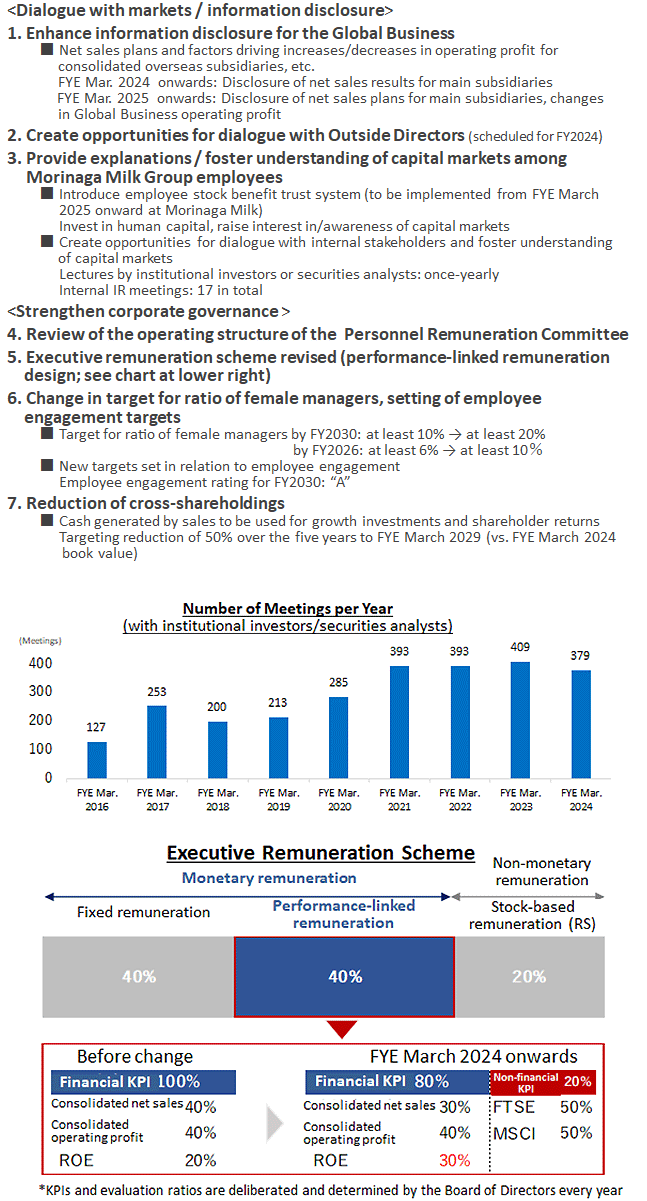

5. Strengthen Investor Relations and Corporate Governance

Reduce cost of shareholder's equity through active information disclosure and dialogue with capital markets, and strengthened corporate governance

This is about strengthening IR and corporate governance.

Dialogue with capital market participants has remained at around 400 for the past several years, as shown in the graph above right. We have been given numerous valuable opportunities. In this context, we have been strengthening information disclosure, particularly with regard to our high-profile global business.

In addition, the lower right-hand corner shows the changes to the executive remuneration scheme. For the performance-linked portion, we have increased the percentage of ROE indicators and added non-financial KPIs to the evaluation axis. The lower left-hand corner shows the reduction of policy shareholdings. We have been taking action in this regard, but this is the first time we are explaining our specific goals.

We would like to strengthen information disclosure and improve governance, not limited to the points listed from No. 1 to No. 7.

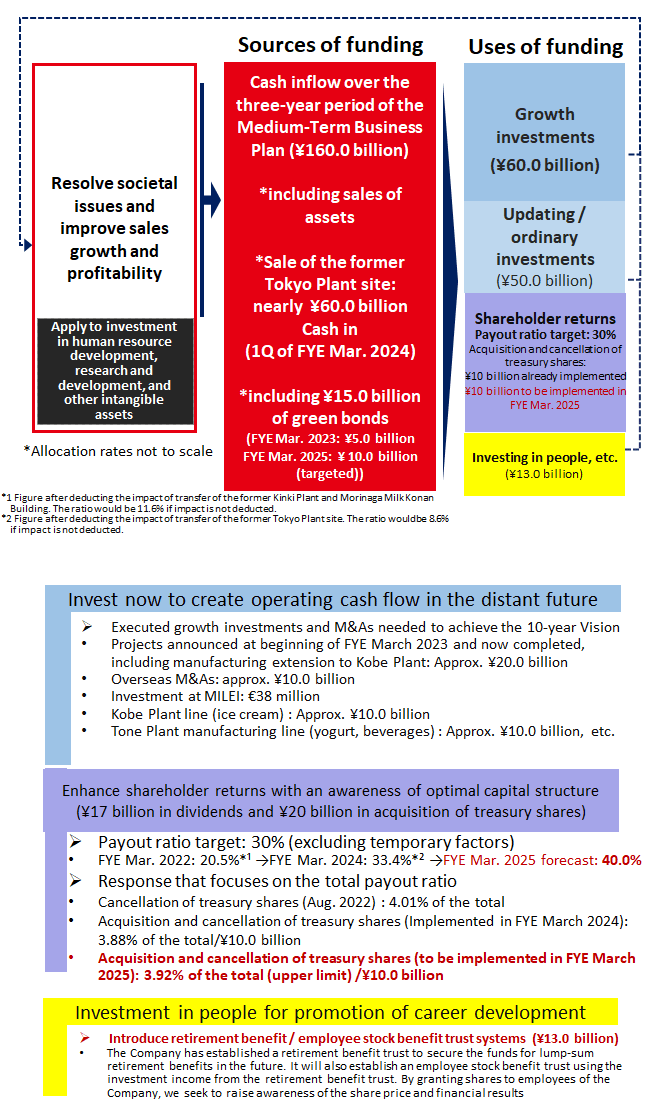

6. Cash Allocation for the Current Medium-term Business Plan 2022-2024

Invest in business expansion / organizational reinforcement, provide shareholder returns as a key challenge (dividend increases + acquisition of treasury shares)

Invest in human capital with the aim of promoting career development and raising awareness of the capital markets (retirement benefit / employee stock benefit trust)

This is about cash allocation(as of May 14, 2024) for the current medium-term business plan.

We will continue to invest as planned in business expansion and strengthening of the Company's structure. On the other hand, we have decided to use the cash that exceeded our initial plan not only to strengthen shareholder returns, but also to contribute to a retirement benefit trust and introduce a stock benefit trust for our employees as a way to strengthen our investment in people. These measures are intended not only to promote human resource development, but also to raise awareness of the capital market among our employees.

In accordance with the policies presented in each of the above slides, we will work to achieve sustainable growth and further improvement in corporate value.

【Supplementary Information】

(Announced on May 13, 2025, “Medium-Term Business Plan 2025-2028”)

We have formulated and announced a new cash allocation plan for Medium-Term Business Plan 2025-2028.

We will focus on achieving cash allocation that concentrates resources in growth areas, utilizing interest-bearing debt to optimize capital structure, and reducing capital costs by strengthening shareholder returns.